TLDR

- Jim Cramer recommended Affirm Holdings, Lululemon Athletica, and Reddit as buys

- All three stocks face challenges despite Cramer’s endorsements

- Affirm is vulnerable to consumer spending pressure and rising delinquencies

- Lululemon shows slowing growth, high inventory, and increased competition

- Reddit’s high valuation and concerning user engagement trends raise red flags

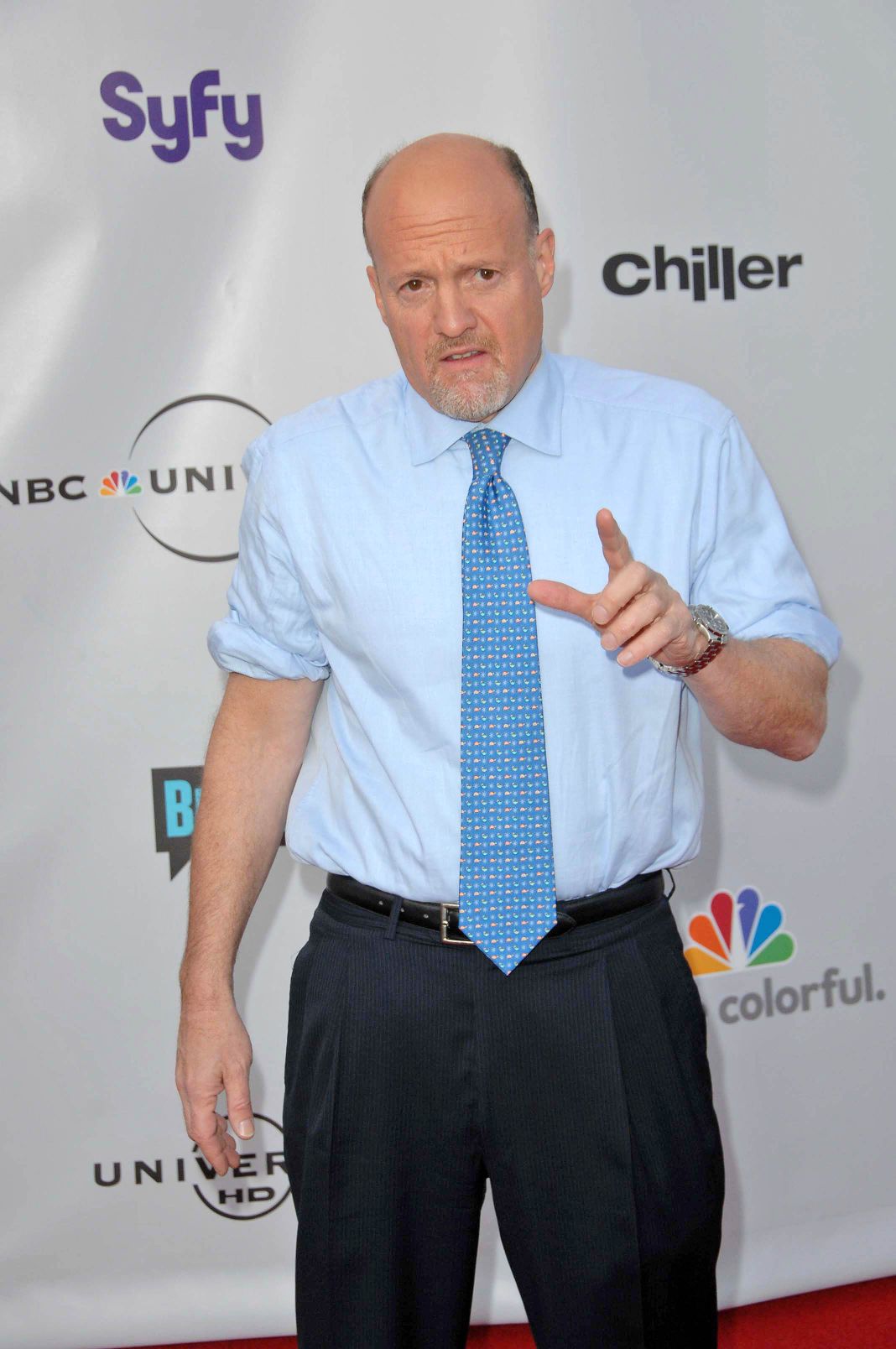

CNBC’s “Mad Money” host Jim Cramer remains one of the most watched figures in financial media. With his energetic style and hedge fund background, Cramer’s stock recommendations reach millions of viewers daily. But his latest picks deserve closer inspection, as three stocks he recently endorsed face serious headwinds that investors should know about.

Cramer’s stock calls have often drawn criticism for inconsistency. Several studies suggest his recommendations frequently underperform market averages. In today’s volatile market, affected by tariffs and economic uncertainty, three of his recent endorsements stand out as particularly problematic.

Buy-now-pay-later company Affirm Holdings (AFRM) received Cramer’s praise for delivering “excellent results.” The stock is down 12% year-to-date but up 70% over the past year.

However, investors should proceed with caution. Affirm faces pressure from persistent inflation and the Federal Reserve’s stance on interest rates. The recent US-China trade deal framework will maintain 30% duties on many imported goods, making consumer purchases more expensive.

Affirm’s strategic shift toward 0% interest loans grew 44% last quarter, now representing 13% of its gross merchandise value. This approach sacrifices revenue for market share at a challenging time.

Rising Defaults and Competitive Threats

Delinquencies at Affirm continue to climb. The company reported a 28% increase in loans 91-119 days past due, with write-offs occurring after 120 days.

Competition from major players like PayPal, Block, and Apple’s Pay Later service puts further pressure on Affirm’s business model. These risks outweigh its growth potential, making it a stock to avoid despite Cramer’s recommendation.

Premium athleisure brand Lululemon Athletica (LULU) is another Cramer pick facing serious challenges. Though shares jumped 9% following news about China trade negotiations, fundamental issues remain.

Lululemon trades at a P/E ratio of 20.8, well above the industry average of 15.5. This premium valuation comes as growth slows. Fourth-quarter results showed 13% revenue growth to $3.6 billion, but Americas sales rose just 7% with flat comparable sales.

The brand’s heavy reliance on China, now 13% of revenue, exposes it to both tariff risks and economic slowdowns in that market. Competition from brands like Athleta, Vuori, and Alo Yoga has intensified, while Nike improves its competitive position through partnerships like the one with Skims.

Inventory issues plague Lululemon as well. Inventory rose 9% year-over-year, with management expecting further increases that will outpace revenue growth this year.

Despite a $1 billion share buyback program, Lululemon’s appeal has diminished, especially among price-conscious consumers. The combination of overvaluation, growing competition, and inventory concerns makes LULU another stock to avoid.

Social Media Valuation Concerns

On April 24, Cramer declared Reddit (RDDT) “a very good stock” and recommended buying. The social media platform’s shares have already dropped 52% from recent highs but could fall further.

Reddit’s first-quarter results showed 61% revenue growth to $392.4 million, with adjusted earnings of $0.13 per share beating analyst estimates of $0.02. The platform generates over 90% of revenue from digital advertising through its conversation ad placement format.

Daily active users increased 31% to 108.1 million globally, with 21% growth in the US market. But a closer look reveals problems with user engagement.

The number of logged-in users grew just 23%, compared to a 38% increase in logged-out users. This distinction matters because Reddit’s business model depends on user engagement. Without logging in, users can’t comment or create posts.

Currently, 55% of Reddit’s daily active users are merely browsing without logging in, up from 52% last year. This trend threatens the platform’s core value proposition.

With the stock trading at 48 times next year’s earnings, 14 times sales, and 65 times free cash flow, Reddit’s premium valuation looks unsustainable given these engagement challenges.

Despite Cramer’s endorsement, these three stocks face serious challenges that make them risky investments in the current market environment. Affirm’s rising delinquencies, Lululemon’s slowing growth, and Reddit’s engagement issues all point to potential trouble ahead.

The most recent data shows all three stocks continuing to trade at valuations that don’t reflect their underlying business challenges, making them stocks to avoid this May despite Cramer’s recommendations.